The IRS recommends that everyone do a Paycheck Checkup in 2019.

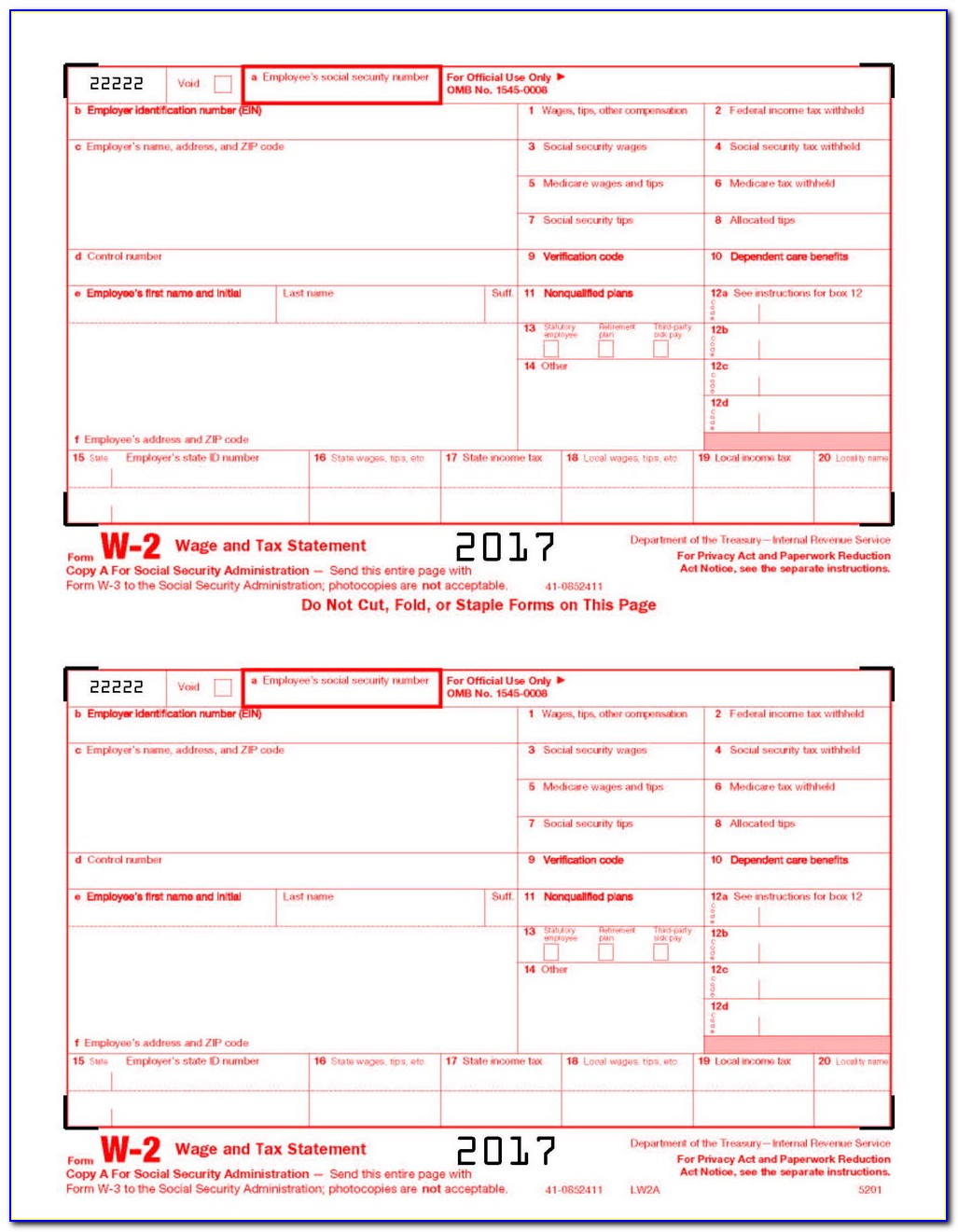

They cannot specify only a dollar amount of withholding. Note: Employees must specify a filing status and their number of withholding allowances on Form W–4. Additional withholding: An employee can request an additional amount to be withheld from each paycheck.Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.Filing status: Either the single rate or the lower married rate.Three types of information an employee gives to their employer on Form W–4, Employee's Withholding Allowance Certificate:.Wages paid, along with any amounts withheld, are reflected on the Form W-2, Wage and Tax Statement, the employee receives at the end of the year. Understand tax withholdingĪn employer generally withholds income tax from their employee’s paycheck and pays it to the IRS on their behalf. Here’s what to know about withholding and why checking it is important. This includes anyone who receives a pension or annuity. The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. Taxpayers can avoid a surprise at tax time by checking their withholding amount. Taxpayers pay the tax as they earn or receive income during the year. The federal income tax is a pay-as-you-go tax. Note: August 2019 – this Fact Sheet has been updated to reflect changes to the Withholding Tool.

0 kommentar(er)

0 kommentar(er)